Frequently Asked Questions About Optiml

Optiml was built to simplify financial planning. Many users ask similar questions about how the platform works, how to read results, and what certain terms mean. This post covers the most common ones and explains how each part of Optiml fits together.

Prefer to watch instead of read?

Watch the FAQ Video on YouTube1. Why does my plan use specific deposit or withdrawal strategies?

Every plan in Optiml starts with one core input: your after-tax income requirement. This is not just a number, it is the foundation of every meaningful financial plan. Before you think about investments, growth, or timing, you need to define two things:

- How much after-tax income you want each year to live comfortably.

- How much you want to leave behind when your plan ends.

Those two answers guide everything that follows. Optiml builds your plan around them, calculating how to meet your income needs in the most tax-efficient way while aligning deposits, withdrawals, and growth to match your estate goal.

Once that foundation is set, your chosen strategy determines how the plan behaves:

- Max Value: Meets your income goal, then prioritizes maximizing the value of your after-tax estate.

- Max Spend: Focuses on lifetime enjoyment by safely drawing your savings to zero by the end of your plan.

- Set Value: Targets a specific amount you want to leave behind and adjusts spending to reach that number.

Optiml does not follow a fixed withdrawal order. Instead, it optimizes across your accounts each year to reduce tax and improve results. You may see deposits or withdrawals from multiple sources in a single year. That flexibility is what makes the platform unique.

.png)

2. What is surplus spending?

Surplus spending represents the extra amount you can safely use in a given year without affecting your long-term goals.

If you tell Optiml you need $100,000 each year and your investments perform better than required, the platform calculates when and how much extra you can spend while staying on track. This period is known as your surplus spending window.

You can view it in several places:

- Cash Flow: Displays all inflows and outflows, with a row labeled Surplus Spending.

- Expenses: Shows the years and amounts when surplus spending is available.

- Run New Plan: Lets you control when the surplus window begins and ends.

If you notice large withdrawals early in your plan, your surplus spending may have started sooner than expected. You can move the start of that window later if you want it to begin during retirement or another phase of life.

3. How do I know if my plan worked?

After running a plan, you will see one of two messages.

If your plan met all your income needs, a Congratulations message appears confirming there were no shortfalls.

If your plan did not meet your income requirements, a Shortfall message appears showing the years and amounts of shortfall.

You can review these results on the Expenses page under Achievable Annual Expenses. This table shows how much after-tax income you could afford each year compared to what you said you needed.

If you find shortfalls, you can update your plan by lowering expenses, adjusting investment growth rates, or changing goals. Rerunning the plan will confirm when you've reached a sustainable setup.

.png)

4. Where can I view deposits and withdrawals?

Optiml makes it easy to see every deposit and withdrawal used to build your plan.

You can find them across multiple sections:

- Dashboard: Displays all deposits and withdrawals year by year. You can switch between combined and individual views if your plan includes a spouse.

- Cash Flow: Shows every inflow and outflow by year.

- Investments: Provides a detailed table of all account activity.

- Action Plan: Lists every step you need to take, including deposits and withdrawals needed to reach your goal.

Optiml runs all these calculations automatically. You never have to guess how much to move in or out of each account. The system determines the most tax-efficient sequence for you.

5. What tools should I check after running a plan?

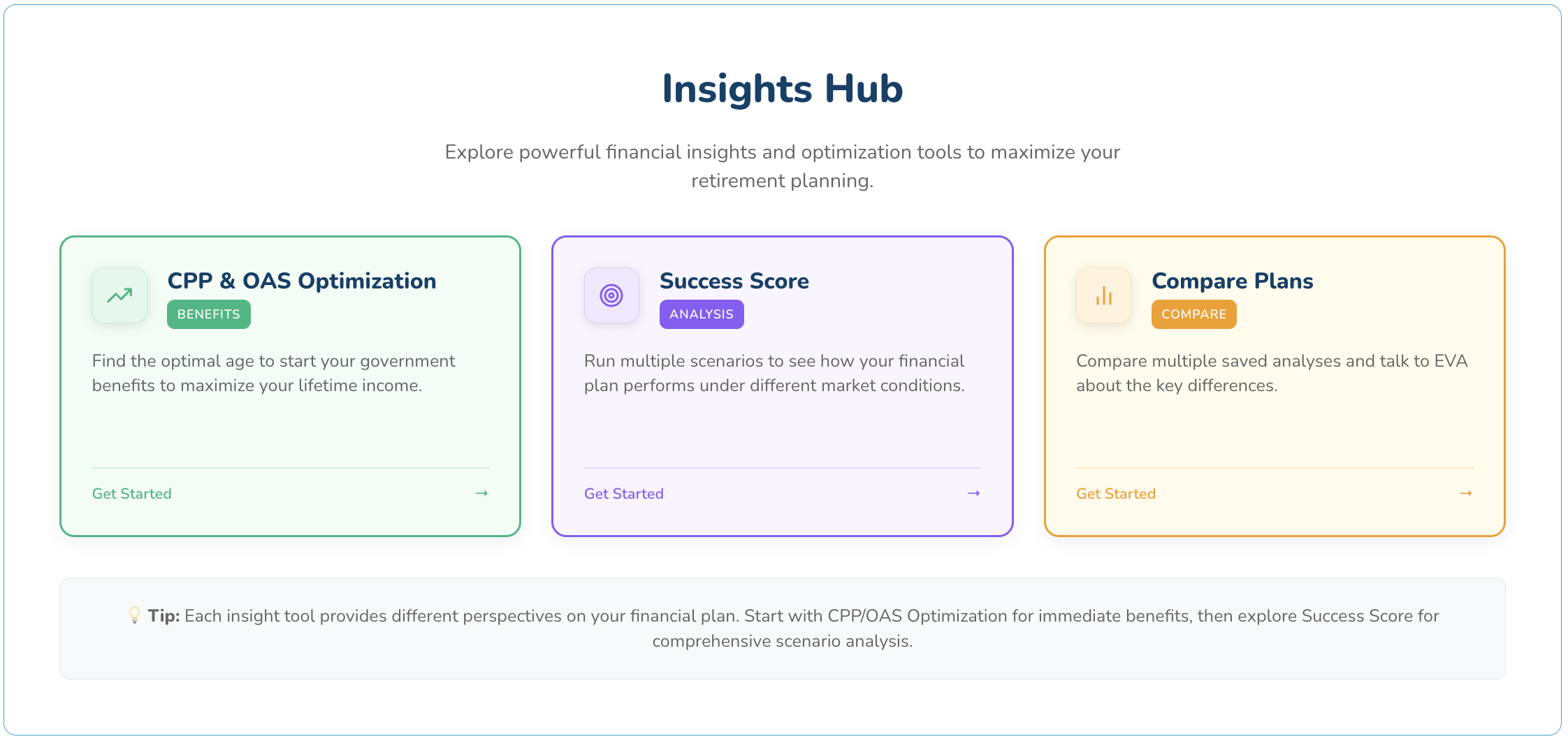

Once your plan is complete, visit the Insights Page. It includes several advanced tools designed to help you test and improve your results:

- CPP, QPP, and OAS Optimizer: Finds the best age to start government benefits based on your goals.

- Success Score: Stress-tests your plan under up to 50 different market scenarios.

- Compare Plans: Lets you view two saved plans side by side to see how changes affect outcomes.

These tools help you understand how different scenarios could impact your plan and where small adjustments can make a big difference.

6. How does the AI assistant Eva help?

Eva is your personal AI assistant inside Optiml. It does more than guide you through the platform. Eva can read and interpret your plan.

You can ask specific questions such as:

- Why did my withdrawals increase this year?

- Why are my taxes lower after age 65?

- What changed when I delayed my CPP?

Eva gives clear explanations using your plan's data. On every page, the AI Insights button offers instant analysis related to what you are viewing. Whether you are looking at investments, expenses, or taxes, you can get context-aware insights in seconds.

7. How do I save, edit, or update plans?

Every time you run a new plan, you can save it to your Analysis Hub. You can name each one and keep multiple versions to explore different what-if scenarios.

When you edit a plan, Optiml automatically creates a new version instead of replacing the old one. That lets you compare plans over time without losing your past results.

Your Master Plan is the version you intend to follow closely. You can edit it directly to keep it current or duplicate it to experiment with new ideas while keeping your main plan intact.

This gives you complete control while protecting your original work.

Final Thoughts

Optiml helps you take control of your financial future with clarity and confidence. It connects your income, spending, deposits, withdrawals, and taxes into one unified view.

These FAQs cover the most common questions we hear from users. Use them as a quick reference to better understand your plan, explore new strategies, and get the most from Optiml. The more you interact with your plan, the better you'll understand how each piece works together to reach your goals.